東京都港区赤坂二丁目14番11号

天翔赤坂ビル7階 〒107-0052

Akasaka Tensho Bldg 7th Fl.

2-14-11, Akasaka Minato-ku

Tokyo 107-0052 JAPAN

有料職業人材紹介事業者

厚生労働大臣許可番号13ーユー309862

Archives Blogs ~April 2019

2019-4-8

Information

Personal Information has become comercial resource as

the information gets digitalized and easily transmittable.

Internet was a tool to share information, attaching value to Personal Information. But the innovations that have since

followed have made information much powerful resource.

The media business has been made obsolete when all

information can be transmitted instantly without

intermediation by humans. We no longer need to wait for news papers in the morning

but can get to the details of events or accidents that happen thousands of miles away.

You would not need to rely on professional journalists to deliver the news to you.

Similarly, our private information is instantly copied, transmitted and shared with those who

will be able to use such information for the sake of their business. Ways to gather as large

volume of personal information for a long and continuous terms are thought of and variety

of smart tools are introduced to the soociety.

Today, all of us give up much information of ourselves for lifetime. 5W1H per each activity

of ours may be all recorded and shared in digitalized formats in the background of our daily

lives. And such poole of data is traded for money as precious resource.

Unlike Coals or Crudes, this new resource for our future society has no limits and last forever.

This resource will fuel the business which generates profits.

Profits will then be distributedto the society eventually.

Until about half a decade ago, people talked a lot about how to protect human privacy and

personal information. Today, we see governments, public sectors, and business all work hard

to collect personal information to make a big data or centralized data pool. They say it will be

good to improve service, develop new products or efficient society. The givernment's regurations

about personal information protection created the rules for information sharing, but were not

meant to stop the flows of personal information.

Some people say information is a key resource to the next century with is value as precious

as crudes or coals in 20th century. It is also said that Internet and a whole range of digital

innovation is driving the path to next industrial revolution.

It certainly is a revolution of the society value, business structure and people's life style.

And we shall have little to be scared of and can believe some bright future ahead of us all;

such that soon, we will not have to work like we used to, and we will not have to move

around as we had to in the past.

Smart Society will go beyond automation or efficiency; and it will mean Smart Work

and Smart Life.

We should all be convinced that we do not hesitate to share our private & individual data

more freely in orderso that our future of Smart Society will come true much sooner.

2019-1-25

On a Cold Winter Day - (2)

I saw an article that science experts alerting that we have

Two Minutes to the End of our Planet Lves.

Doomsday Clock has come to 'Two minutes to Midnight'

as a famoust UK heavy metal band, 'Iron Maiden' used to

sing. They say it is attributable to ever uncontrolled CO2

emmission gas that is warming this planet.

Yet, it is very cold with snow storms blowing around the world; and even in Tokyo, winds are cold

and it is supposed to snow this coming weekend. The weather from mid-January to early Feruary

has always been like this since my childhood days; and, as just we feel the air around us, and

as ignoring the scientific data, it seems that little has changed about the cold winter at this time

of year.

There are so many, though, that have changed around us over the last few decades.

When I started my banking career at a US bank, we had no PC on our desk. No mobile phone or

no e-mails had existed. We relied on a telephone on our desk, and telex print-outs that were

delivered from a telex operation room. Fax machine was not yet so popular, either.

When doing my corporate credit analysis, I recall having to spread 5-year historical financial

numbers, itemby item, and ine by line, on a piece of paper; and using my calculator, not even

one made by HP, make a whole set of financial ratios to analyze the year-on-year growth and

changes of various financial indicators.

Having done all, and then I made financial projections for the next 5 years to come, once again,

all manually, with a small calculator and papers. With no PC, there was only one way to keep

the work outputs; (i.e. filing papers in physical files. In order to share the result at meetings,

we could only photo-copy the papers by, the then super office machine, a Xerox copier.

It was only late 80's that IBM PC's were placed on our desks. We had Lotus 1-2-3, which was

somewhat an ancient type of today's Excel or similar software to create calculation sheets.

E-mails were not yet there, so we had to print the outputs for sharing and circulation.

Fax machines replaced telexes that could be sent only by specialist telex operators, so that

people became able to choose their own timing to communicate with people outside.

Younger generation who had not lived through the days can hardly imagine how we could work

on deals which were as complex as the deals they work on today.

Technology has made so many things faster, simpler and efficient. Today, we can read emails

on mobile phone, and even send and receive excel or power point files wherever we may be

and whenever it is. We thank Humans for all these.

The style of our work and living have changed so much, and perhaps there are areas where

we burn less energy and also where we use more powers.

World has changed, scientists say, but it gets cold in winter and it gets hot in summer.

However, the way we live and work everyday has changed so much thanks to all the technologies

enabled by great scientists.

It may not be a question of whichever way we would want our emvironment to be, but it may be

a matter of how we should preserve the value of our planet while we make our human lives more

and more efficient.

It is once again a time to test the great brains of or scientists.

2019-1-18

On a Cold Winter Day - (1)

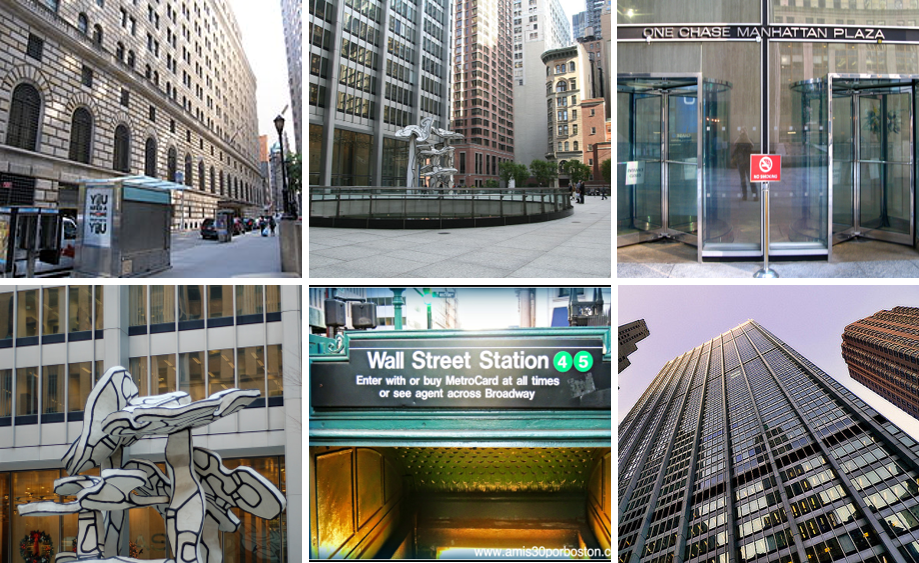

During this time of year, cold winds blow through concrete

buidings. When coming out of the subway station, feeling

the cold air, I recall the days of my working in Manhattan.

After a few years in Asia, I moved to NY Headquarter of

The Chase Manhattan Bank, N.A. - which today is known

as JP Morgan Chase. Its headquarter building was, located

next to Federal Reserve Bank and a minute off Wall Street, a 60-story skyscraper built by David

Rockfeller, who was then CEO of the bank.

From mid to late 80's, the old corporate lending based credit & marketing business model was in

transition to global corporate finance & capital marketsbusiness model. With no expectation,

I was placed in the middle of such transition. The bank, known as one of the top rated money

center banks, had been hurt by credit problems in Latin Americas, and was testng a series of

restructuring. Externally, they were also exposed to challenges from large securities brokers who

were quickly expanding their securities business globally. Being fueled by rising stock markets

and helped by fast growing activities in international securities markets by large institutional

investors funds, US securities houses were quickly expanding their capital markets activities.

About the same time, in London, so called 'Big Bang' was announced, and banks are allowed to

enter into securities brokerage business among all the other deregulations of market businesses.

Banks from the continental Europe, and securities companies from US were those to quickly

jump into the fierece competition only to win market share of the early days of Eurobon market.

Chase, and other US banks, however, being regulated at home by Glass-Steagall legislation, were

neither as fast nor as aggressive in activity in Europe.

UK Clearers were also struggled to compete banks from Germany, Switzerland, etc. who had

longer history of unversal banking business models. However, it appeared, after all, that US banks

lost little while large Eurobond houses had made so little money on the back of fierece race to win

many dog deals, by cutting every possible cents on underwriting prices and by writing "bought

deal" tickets with pre-matured distribution platform. In those days, banks in Europe, and UK to

some extent as well, had strong & lucurative retail business franchise, so that, unlike more

regulated US banking sectors, banks in Europe had powerful balance sheet, whic was indeed

supported by more generous captal adequecy rules to reguate the banking business of those days.

While many banks lost money to win shares of Eurobond market which eventually collapsed itself,

corporate mergers and aquisitions in US were becoming active on the back of rising equity market.

Banks, like Chase, Morgan, Citi, Manufactureres Hanover (Manny Hanny) were those who quickly

took advantage with their strength in credit lending & distribution.

Billions of dollars worth of new deals emerged every week, almost all of which were leveraged by

huge bank loans. Banks were able to secure their fees while sharing the risks among joint

bookrunners. Bookrunners kept all control of the deal, not just commercial terms and conditions,

but also documentation, syndication, and fees.

Banks from Europe, UK and Japan were considered to be "stuffees", - deal hungry with balance

sheet capacity but no deal making experts on the ground.

By the time these foreign banks becoming aware of the deals, the deal terms woudl have been

well cooked and done for delivery to the market. The best part of the deals would have been

shared among the deal sponsors (PE funds, etc.), investment bankers and bookrunner banks.

What evolved from those days in US corporate market seems to have created the base for what

have later become the market standard and/or common practices, which we see even today, and

in the global market places. There were many "try & errors" by those who had worked long hours

of work every day and night during those years. As I recall, however, everyone on the Street

had little hesitation or few complaints about the amount of time they had to spend to make their

deals happen and work for clients. Those were the days of hard & long hours of work, with which

people felt satisfied and enjoyed being in the center of the corporate finance parties.

Clearly, those were good old days, and were different from the recent days.

I could go much longer writing memories of, and lessons from, those days.. but I will stop now.

The rest of the story shall, perhaos, continue on another day.

2019-1-17

More expensive than free meal ?

One day, you get approached by someone who claim to run

a school about financial markets and investments.

He'll claim he has made great fortune by his personal investment; and, because he is so nice, he says, he is obliged to

share the secret of his success with those who innocently

want to be rich.

He will invite you, if interested, to free sushi dinner party at his place, and then to his seminars

that are indeed marketing tools of his money making machine. In front of all joining such events or seminars, he will go on and on about his way of viewing investment products, markets and life.

He is good at using simple terms in his explanation; so that those having little knowledge of

financial markets may understand his story or lectures. Very often, he uses very direct and

straightforward words in strongly denying what are deemed to be the market norm or industry

standard. He quietly and softly repeat nothing special, things which are well known by anyone

or things that do not take much of special knowledge to conclude.

He will often defer explanation or analysis of complex issues with remarks, often made,

"you may not understand because these are overly complicated for you. But, don't worry,

all you need to do is to trust my words, the words from the man of experience. You may feel

completely relaxed and rest assured."

Anyone with a bit of knowledge about financial markets might wonder what value he is bringing

to the audience. "None", should be the answer. Apparently, he is not giving anything to his

audience while he is gaining his self-satisfaction by making people listen to and watch him with

much of respect and jealousy. He seems to be enjoying with it.

To be honest, you won't know what he did to achieve what he calls a big success; or you won't

be sure what he does all day except speaking what he feels like speaking off his sloppy month.

He hires people to play as his messengers to broader audience, who will do what will make

their boss shine more. The way they work in a group reminds you of a kind of cult group.

They invite people to free 'sushi' dinner events, where the founder of the group speaks how he

made his success and how he wants people to share his happiness by leaning his way of living.

He will say he is doing what he does because he is a nice person.

In order to run their activities, costs are involved and they need raise capital.

So, at the free dinner, they gently invite people to their official seminars, which people will be

required to pay participation fees to attend; and they will eventually aim to persuade people

to sign up for their school, which they run, that will cost people some fixed charges for a period

of several months. Of course, you will hear from them that seats are getting filled so quickly

and there will not be vacant seats available for everyone.

You wonder what they teach at their school. Contents provided by the school include a long list

of lectures about financial markets and investment products.

Once again, you may be disappointed by finding the list being full of no surprises. By the way,

teachers are not licensed and no proof of their qulifications are given.

They also sell products: insurance producs and real esates. Their sales forces call themselves

"consultants" - but their job is to sell these products. They are not licensed either as insurance

broker agents or real estate dealers. They most likely make substantial selling jobs but do not

execute deals. Instead, they make "introduction" of their clients, often picked up as students

of their school attendees at seminars or sushi dinner events, to third party licensed broker

dealers, and agents.

To clients they give no representation or warranties on what they sell, and let the third parties

take over all liabillities and responsibilities. For their introduction, consultants receive

remunerations from the broker dealers or agents who close deals with clients.

The group is not licensed as Financial Instrument Exchange Agent or Dealer.

So, they carefully choose not to act as if they are soliciting investments or providing investment

advices. Truth of the matter, however, is unknown, but they do speak to their clients a lot about

what to do and what not to do, or what to buy/sell and what not to getinvolved in.

Apparently, they had once thought about applying for Investment Advisory license under Fnancial

Instrument Exchange Act. But they say they gave up; - and they gave up because they found

no value in it. Is that right ? One might suspect they had to give it up because they could not

manage to meet all that will be required to keep the license.

They say they do not sell or advise on Financial Instruments; but they do teach in their school

and at their seminars much about Financial Instruments, not for the sake of making the attendees

knowledgeable but to make them learn what to do. Practical measures for and secret of success

will be shared by the great founder of the group, they say it being the key mission of their school.

By the way, their top recommended product is a property investment in a developing coutntry.

Details of this product is, however, not shared until participating the paid seminars. They say

their product will enable one to own a piece of land in the midddle of nowhere in a developing

country. And their logic is that the land prices will soar as the economy of the country start

booming, which will happen for sure in the very near future.

Anyone interested may join free sushi dinner party, but tickets will go very quickly.

2018-12-3

Gettin' around in Tokyo

One more blog about transportation within Tokyo...

For the sake of foreign visitors, Tokyo taxis are being

renewed. New vehcles look like black cabs in London.

They are taller and provide more leg space in the back

seat areas. The sliding & automatic doors will welcome

passengers and passengers may find various signes

inside the cabs in English, Chinese and Korean languages. Drivers are said to be taking

English lessons so that they may be able to say a few words in English.

Not sure how good they may be; and whether drivers are enjoying their English lessons.

New vehicles give more space for passengers; but less for luggages.

Travellers may struggle with their large-sized globe-trotters and their over-sized bags

because they find the trunk room spaces being very small. Beises, there will be serious

disappointment visitors may feel.

Taxi drivers in Tokyo do not come out of their driving seats when passengers struggle with

their luggages. They watch you through their room mirrors to make sure that their shiny

vehcles may not get scratched or hurt by passengers trying aggressively to push their

hard suit cases into the small trunk spaces.

Rarely, at airports, you may get the drivers walk out for you to help you with luggages;

however, most often, when you are in town, you must help yourselves as you cannot

expect your taxi drivers to willingly offer their assistance with your luggages.

Yet another disappointment for all is that many drivers of today are not familiar

with the roads within Tokyo. They are not as well trained as London cab drivers, or the

streets in Tokyo are never as easy as those in Manhattan.

There will be so much reliance on 'GPS car navigators' which will not necessarily be

the best of the solutions. They do not show the best way to your destinations.

In congested roads in Tokyo, the shortest ways in distance may not necessarily be the

shortest way by time. You could easily get stuck in traffic and waste your time while

the drivers care least because their meters run, not only by miles, but also by time.

Japan, as a whole, spend so much money for "o-motenashi" for foreigners;

whatever that may mean or how much value people may really find in it.

The truth of the matter is that they are lilely to me missing something.

They care about how well they look; but ithe truth of the matter is things can only

get worse for those who are repeat visititors or residents; that is: getting around

in Tokyo has become, indeed, more unfriendly and stressful than before,;

whether travelling by subway system or by taxis.

2018-11-9

Subway System in Tokyo

Tokyo is proud of its Subway ("Tube") System.

With 13 different lines, one will be able to reach 285

different stations. There are over 8.6 million passengers

pet day and the entire system, when all combined, reach

as long as 305km. Tokyo's subway is No. 1 of the world

in its total number of passengers, but is only surprising

that it is only the 7th in its total kilometers that it runs.

The reality today is, however, different from what one used to hear.

There is one serious problem that many local users feel about nowadays is that the trains are

more crowded, and run with more frequest delays.

Trains being clean and passengers being polite are no longer truth.

Over the last few decades, many of the subway lines have been connected with trains that

come from, and go to, surburban areas,

It was intended to serve passengers commuting from distant homes with more convenience;

but such intention indeed worked agaist the passengers who live in metroplitan areas.

Thos who paid more to buy or rent houses or condominiums in metiroplitan areas, with

wishes to make more comfortable commuting, are now completely disappointed.

Thos who used to enjoy lives in metroplitan areas with great convenience and comfort by

the subways now find the subways are full of passengers from non-neighboring areas.

What is worse, these passengers rush into train cars, push people over to secure their

seats. Train cars are filled with those people's sweats and noises.

Furtthermore, trains connected from subways to the distance is causing more delays.

When going out of the original subway system area, the trains run on the surface, not the

underground. Bad weather, gusty winds, snows, or anything that affect the trains safety

will mean that the trains will be seriously delayed or cancelled.

It would be so much better all trains outside the subway system are cancelled, then the

residents in metroplitan areas feel they return to the old days; (i.e. days with peace and

quiet travels by subways to and from offices or schools.

However, such won't happen so often. In most cases, trains from the distance run with

delays, which slow down the subways, and make series of causes for unexpected stops

or unbearable crowdedness.

Decrease in the national population is a problem for this country indeed; however,

people might think that it will be one definitive way to bring them back to the good

old days of life with Tokyo Subway System.

2018-10-15

Business as Usual

This Website was finally made public as of last Friday

and a short message from us was sent to those friends,

former colleagues, clients, partners, etc, who had some

dealings with us in the past, and we announced the

opening of our new venture.

Hopefully, with a tool like this, many more people will

find us to let us share more joy and pleasure of work

together.

For those who have known us for some time, things will just continue as always

although we might be a bit more proactive in seeking opportunities.

No real changes whether a venture takes the form of a company or not.

Life goes on as usual.

2018-09-20

Trading Business

Think you trade and be free of profit & loss responsibility.

You are authorized to make your calls as to when,

what and how to buy, and to sell; and you are also

given allocated capital and funding to support trading

position. You may be successful in your trading so that

your trading account show profits; or you may make

a series of wrong decisions so that you accumulate losses which would reduce the capital of the firm.

In a world that we are used to, performance of trading was mesured by the amout of

risks taken and the profits or losses resulting from trading & risk management.

The world changed, as it appears, so that trading authority and p&l responsibility may be

separated.

One institution created a trading book, and gave someone dealing authority with trading

limits and capital. The one who runs this trading book is expected to make his professional

judgment to make the trading operation successful. However he was given no responsibility

for the profits and loss on his trading account. He is expected to pass any profits or losses,

which being attributable to his trading performance to the other departments, who have no

rights or influence to trading decision.

You'd wonder how this trader might really feel when his profits goes to someone

else while he can also pass losses to someone else.

Furthermore, You might wonder how someone who does not trade may be made

accountable for the profits or losses that was created by a trader working in another

office building.

What might surprise you is that this new concept was introduced by top management

of one major firm in a major market.

He indeed never trade in his whole career but as a president he is responsible for

the entire profits and losses of the firm.

Does it sound all right ? I guess the answer is NO because this new rule will collapse

the business dicipline.

If we move to a next stage of robotic business, someone will have to be made

responsible for the profits and lossses made on automated trading robot.

Hopefully it won't be reverse; i.e. you trade and the robot will be responsible for the

profits and losses.

2018-09-14

Gettin' Ready for Unpredictables

We have experienced many disastors caused

by the nature. Recent quakes across the country,

and across the waters in other continents,

caused the lives there at risk, and brought

the people living there great inconvinience.

When going through those difficult days,

we come to realize what will be the ultimate

needs of human lives; which are : amongt all, lights, water, fire and information.

You might think of many others, such as food, toilets, lines, blankets, etc.,etc.

By the time one worries about food, one woulld have found a place to breathe,

lights to enable a look-around. The very basic technology of human is fire, and

clean water, wich will be essential for human survival.

What about your access to information then ?

If it is only for a human survival, one might be able to live without any access to

information. But we have come a long way since the first human being started lives

on this planet, and we have lost our skills or instincts to learn things from the nature.

We have learned to read, hear or watch televised or printed information too much.

Besides, the latest advance in infrmation technologies have made us so much reliant

on smart phones and internet. Unfortuntaely, those techinologies will only work with

electricity. Electricity wil have become scarce commodity when a big natural disastor

hit our lives. Your smart phone's battery will last only for some time, during which

time there may be litte information being available as the new wire stations may not

be functional. Even though the news reporters from distance may try to gather information,

they might not be successful until the chaos in the disastor-hit area come to hold

themselves in order to dispatch on-site information.

After the heavy rains of this summer, and after the latest quakes in Hokkaido, we hear

many experts on media alerting us of "what if the same hit your place ?", or "what if

some large tsunami hit Tokyo Bay ?" They show their some simulation and their anlysis,

which all sound very serious and even likely.

Following 3.11 (Fukushima quakes), Tokyo Metroplitan government accelerated its

public stroage of bottled water and other necessities that may be provided in emergency.

Many large corporate offices also started keeping their own storage of water

and food. All these assume that thise storage will be safe and access to them will

be secured even after a disastor comes to reality. Also assumed that people will be

mobile soon after the event.

Well, one can do so much to prepare for unpredictables knowing that nothing may be

sufficient when they come to reality. Let us hope that we will all be safe no matter

what happens, and we shall not just be alive but also remain connected via free wi-fi

internet service.

2018-09-13

Red Carpet

In Japan, many brand new hotels and shopping

complex are being built in Metropolitan area.

Construction works and business opening are

set for 2019 - 2020 Olympics.

More accurately, they are for inbound visitors

who are anticipated to come visit Japan for

events around 2020. Anothe factor is to respond

to Japan government-led drive for 'the Nation's new

growth strategy with Inbound Tourism.'

Japan now expects inbound tourism make contribution to its future economy while its

local population will continue to decrease. Therefore, Japan is now busy making a high

quality and broadly-spread 'Red Carpet' to welcome visitors.

For many years Japan has long been perceived as a country and people of politeness,

safety and cleanliness. If such perception being accurate, then why they need to go

so crazy about preparing for an event that goes for a few weeks only.

There should be nothing for local Japanese to worry about only to receive people whose

standard of politeness, safety and cleanliness are believed to be lower than those in Japan.

Indeed, shops and restaurants should be more worried that their local customers may be

annoyed by the noises and crowds of those visitors who would make noises and mess

in the common areas. Hotels shoud be worried that they will need to cope with those

who do not speak the local language. Police should be alerted of potential dangers

and threats that might hit the quiet and peaceful livings of local communities;

and further of unprecedented traffic jams that may be caused by unsual moves

of those visitors who do care least about the daily traffic of local commuters.

On the contrary, Japan as a whole seem to befocusing more on 'OMOTENASHI' -

their special way of hospitality to the visitos; that is how to make the visitors feel

at home and comfortable at the cost of local residents.

If such being a ultimate goal, how about keeping the streets with trash and dirts,

importing crime makers from offshore, and hiring many more foreigners at shops

and restaurants to serve the visitors during the event period ?

This way, visitors will find the place with comfort because they will see what they

are used to finding in their daily lives at home. And business and public sector in

Japan might think moreabout smarter ways to spend tax money to make Japan

truly cofortable and a better place for aging society that will last a lot longer than

a few weeks in one summer.

It is, of course, nice to clean up the house before your frinds' visit; but you would

not have to refurbish your kitchen only for the sake of one weekend event.

You will never think of remodeling your house only because your friends from

overseas ar coming for a short stay. You cannot change your spouse just to

make you look better when going to a dinner reception.

Some basic things may be going wrong in this country. In fact, many locals living

in central Tokyo area are planning to be away, avoiding all troubles while 2020

games are in town. you may hear many good restaurant & shop owners in Tokyo

are not necessarily looking forward to crowds of unexpected customers with

whom they cannot communicate. One might wonder who really is excited with

joy about 2020 games in Tokyo.

トピック・新着情報

FundGarage,com主宰の大島和隆氏と業務提携をしました。

始めました。

One As1a Network の親会社のLegan Development Limitedの

日本駐在員事務所を開設、日本市場進出に向けた投資活動を開始しました。

INDEPENDENT CONTRACTOR契約を締結しました。